The Golf Car Industry Due for a Shake-Out, but Longer Term Outlook Good

Significant shifts in demand and supply are likely to trigger sticker price declines and a shedding of some of the new entrants that emerged in the COVID and post-COVID period. What are some of the key characteristics that point to winners and losers in this highly competitive market?

Here are the winners:

• Have a solid network of dealers;

• Few or no supply chain issues with regard to parts;

• Warranties that can be counted on;

• Dependable and efficient servicing and technical support;

• Brand recognition;

• Capable of profitable operation at discount pricing.

The losers will invariably be lacking in one or more of the above.

New entrants—the pluses and minuses

Broadly examining the new entrants, they exhibit both strengths and weaknesses.

Strengths—

• Clear focus on the LSV/PTV market;

• Models feature the latest upgrades;

• Lower price strategy buttressed by relatively cheap partially-assembled vehicles from China.

Weaknesses—

• Little brand recognition;

• Dealer network is undeveloped;

• Early buyers may find issues with servicing and parts;

To the degree that a new entrant can shore- up these kinds of potential weaknesses, the far better its chance of surviving the competitive fallout.

Getting beyond the short term

The big reason for surviving in the short term is to flourish in the better market and competitive environment that emerges beyond the next 12 to 24 months. Small Vehicle Resource has just published a forecast of the market for the period 2924 to 2030. The outlook for the industry as a whole is positive.

The big reason for surviving in the short term is to flourish in the better market and competitive environment that emerges beyond the next 12 to 24 months. Small Vehicle Resource has just published a forecast of the market for the period 2924 to 2030. The outlook for the industry as a whole is positive.

Underlying this positive outlook are four favorable trends that actually started before the COVID pandemic, and are very likely to continue well into the forecast period.

• Population movement out of urban centers into surrounding suburban areas and beyond;

• Home office deployment of the professional workforce continues, making the exodus from urban center offices feasible;

• Population movement on a broader scale from colder northern limes to the south with its warmer weather;

• Age distribution of the U.S. population continues to shift toward and older populace.

All four of these systemic trends favor the GCT industry and will expand the potential market for GCT vehicles.

Price drop? All is not lost!

The consensus of those that SVR talked with at the 2024 PGA Show was that there would be a decrease in prices in GCT vehicles at the retail level, as a result of increased supplies. From new and recent market entries.. That is what is actually occurring, but there are at least two mitigating factors on the more optimistic side:

The consensus of those that SVR talked with at the 2024 PGA Show was that there would be a decrease in prices in GCT vehicles at the retail level, as a result of increased supplies. From new and recent market entries.. That is what is actually occurring, but there are at least two mitigating factors on the more optimistic side:

• Lower prices will attract more buyers;

• Greater product variety, featuring an array of upgrades and accessories could well work to sustain profit margins.

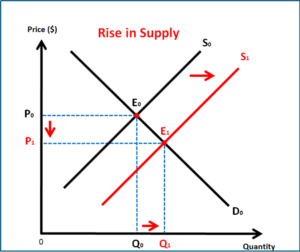

Economics 101 tells us that a shift rightward of the supply curve, as seen in the diagram below, it intersects the downward sloping demand curve at a lower price point, but the good news is that quantity demanded (i.e., purchases) increases. Thus, in what may be difficult times for some dealers, for the industry as a whole, the market could well expand.

In the longer term, say by 2026, the market will have decided the survivors and the non-survivors. Thus, the supply curve now shifts leftward, bringing higher prices, albeit

Best of all worlds

The best of all worlds would be a simultaneous shift rightward of the demand curve, thus supporting higher prices, while at the same time experiencing overall market growth.

The favorable systemic conditions, cited above and experienced on a national scale, all create an environment in which the use of GCT vehicles will be more readily accepted. As new communities are developed and present communities adapt, the acceptance of GCT vehicles as a viable and desirable alternative to conventional automobiles will at the same time increase. The GCT vehicle will be the go-to solution for short distance driving.

Again, the headwinds of the current market may take its toll, but the tailwinds of an improving long term market environment, innovation and upgrades, and growing public acceptance will, in all likelihood should propel market growth in the long term.

But design innovations are needed

In many ways the industry is still mired in its golfing legacy. This is not to denigrate golf or the golf-related segment of the market. This segment is quite viable, and while not a growth market, it is nonetheless bread and butter some OEMs—in particular the Big Three, Club Car, E-Z-GO and Yamaha.

The LSV/PTV segment, however, is the growth segment of the market and where the promise of higher margins lie. Many dealerships selling these vehicles brand themselves as golf cart dealers, encouraging the image of golf and moving about a golf course. In many cases it is the consumer who is leading the way into the short distance driving market of emobilty; that is, in terms of image change.

New entrants and the shift rightward of the supply curve: Lowere prices but increase purchase.

OEMs wishing to present a new image, and project the benefits of short distance driving with small electric vehicles, might well look to Europe for inspiration. The vehicle below is one of many small electric vehicle prototypes coming out of Europe. Picture is the Eli Zero, reportedly to be rolling out in ten European cites. The Zero is classified as a quadricycle, meaning it can be designed to reach highway speeds. Introduction in the U.S., which limits low speed vehicles to 25 miles per hour, would not take advantage of the full range of the vehicle’s capabilities.

Nonetheless, the concept of a fully-enclosed, weatherized cabin with all the creature comforts is a direction open to U.S.-based OEMs. With minor design changes golf bags could be accommodated, if one insists on maintaining some connection to golf cart history and its legacy.

Reform the NHTSA restrictions

If there is a real purpose in achieving a zero-carbon footprint in transportation, some thought should be given to modifying the highly restrictive NHTSA standards for low speed vehicles. The answer might be to create another vehicle class, such as the quadricycle, as used in Europe. This would create an intermediate class of vehicles between LSVs and conventional automobiles.

_________________________

Contact the Author: Steve Metzger at smetzger@smallvehicleresource.com. Or check out our website at www.smallvehicleresource.com, where you will find an extensive database of vehicle models and can make side-by-side comparisons of vehicles based on a full set of specifications.