Potential Impact of the International Trade Commission Investigation into Low Speed Personal Transportation Vehicles

The U.S. International Trade Commission (ITC) is currently investigating low speed personal transportation vehicles imported from China with regard to two aspects:

- Whether the LSPTV production in China is being subsidized by the Chinese government, and/or whether;

- Such importation, subsidized or not, is injurious to domestic manufacturing companies in the industry.

The investigation was brought at the behest of the American Low Speed Vehicle Manufacturers’ Coalition, the coalition consisting of two companies—long time competitors in the industry—Club Car and E-Z GO Textron. Should the investigation find that Chinese vehicles are either subsidized by the Chinese government or are being “dumped” into the U.S. market, or both, countervailing duties or anti-dumping tariffs may be assessed against these imports Such tariff penalties could have a major impact on industry growth and development.

This article provides a synopsis of industry and market development over the past two decades and analyzes the potential consequences of a protective tariff, such as the remedy sought by the American Low Speed Vehicle Manufacturers association.

The enemy of my enemy is my fried: How the industry has changed over the past decade

For several decades, two companies dominated the golf car industry. These companies were Club Car and E-Z GO. Yamaha Golf Cars was well-established also, but held a much lower market share, compared to the dominant duo. The major market for the vehicles produced by these companies was golf course fleets. With the surge of new golf course construction of the late nineties and early two thousands., the big three, particularly the big two, saw major gains in sales.

Contenders and challengers to the dominant three came upon the market, e.g., Fairplay and Melex, but were no match for the established brands. During the first half of the initial decade of the 21st century, however, at least two companies achieved sustainable operations, tut concentrated on personal transportation vehicles (PTVs), rather than golf carts. The most prominent of these companies were Tomberlin and Star EV.

PTVs overtake fleet golf carts

In the period 2017-19, it became apparent that the PTV market was overtaking the fleet market in terms of unit sales, and very clearly in terms of sales value. PTVs enjoyed substantially better margins and were more profitable. The dominant companies in the fleet market moved into this market with vehicles designed for personal use, and which could also be used on golf courses.

Club Car set the tone with the introduction of the Onward™ in 2017, a model which has been popular ever since, with numerous upgrades in performance and accessories. E-Z GO upgraded its Freedom RXV line and introduced the Express models. Both companies equip their PTVs with lithium batters, either standard with the particular model, or as an option.

COVID and a new manufacturing paradigm

The onset of the COVID epidemic impacted the market in two major ways. First, with travel and personal interaction widely discouraged, the demand for PTVs, particularly street legal PTVs, or low speed vehicles (LSVs) surged upward. Second, on the supply side, supply chain disruptions and delays resulted in a new means of packaging parts and drivetrains in which partial assemblies of virtually complete assemblies took place in China and then shipped to the U.S. for final assembly.

With the partial assembly investment taking place in China and final assembly investment located in the primary market area, the cost of market entry declined substantially. This, in turn, spawned numerous startup companies and transformed the industry from what had been a concentrated duopoly into a far more competitive market.

Competitors become collaborators

Given the rapid evolution of industry structure, Club Car and E-Z GO, once fighting tooth and nail for market share pretty quickly found common ground in an effort to keep imports out of the market to the degree possible. A free market economist would say there are two ways to keep imports out of your market. The first would be to introduce new manufacturing methods which cut cots below those of the importing companies. The second would be to introduce new products with features that improved vehicles do not have. This is the dynamic of the competitive market model.

Club Car and E-Z GO have chosen another path, at least for the time being. And that is to petition the U.S. Federal government—specifically the Department of Commerce and the International Trade Commission—to impose tariffs on golf car-type vehicles coming from China. This would include the partially-assembled vehicles. This would be called the “government protection” model.

Pros and cons of tariffs imposed to protect a domestic industry

From the standpoint of post-World War II policy both parties, Democrat and Republican, have supported free trade and are committed through membership in the World Trade Organization to lowering obstacles to trade, those obstacles including tariffs and quotas. There are, however, situations in which this general policy can be set aside, and it is just such a situation which is the foundation of the Club Car/E0Z GO petition.

In particular, the two companies contend that Chinese imports of golf car-type vehicles are being subsidized by the Chinese government, thus artificially lowering their costs, and leading to unfair competition in the U.S. market. This unfair competition has resulted in injury to the domestic industry. Such a contention validates the petition for relief which is now before Commerce and the USITC.

In its preliminary phase of evaluating the petition, the USITC determines, on the basis of the best information available to it at the time of the determination,

(1) whether there is a “reasonable indication” that an industry is materially injured or is threatened with material injury, or

(2) whether the establishment of an industry is materially retarded, by reason of the imports under investigation.

The USIC through its four currently serving commissioners reached the conclusion, based on a preliminary hearing held in July, that there is indeed a “reasonable indication” that the industry is materially injured by reason of Chinese imports. The Commission and Commerce is now in the process of conducting an in-depth investigation of the matter.

The argument against tariffs, even if the product involved is subsidized is indicated in the next section.

Econ 101 – The Tariff Impact: The good, the bad, and the ugly

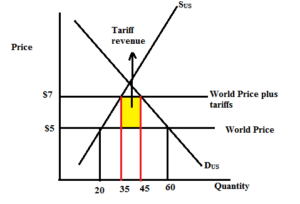

The basics of demand and supply in the diagram below show a negatively-sloped demand curve, obeying the law of demand, and an upward sloping supply curve , obeying law of supply. The law of demand simply says that as price declines, quantity demanded increases and vice versa. The law of supply says that as price increases the quantity supplied increases, and vice versa.

The price of golf car-type vehicles from China is at the $5,000, while the domestic price without any imports lies at a point above $7,00. A tariff is imposed raising the price of imports to $7,000.

The Good: Domestic producers increase production from 20,000 units to 35,000 units. Imports are reduced from 40,000 units to 10,000 units. And the U.S. government picks up revenues indicated by the yellow rectangle.

The Bad: Price sensitive consumers move out the market, reducing market size from 60,000 units to 40,000 units

The Ugly: Smaller market size could also translate into lower growth of the market in future periods, a result which neither domestic manufacturers, nor importers would want to see.

Another argument in favor of the tariffs would be that such protection would give domestic manufacturers time to adjust to more efficient manufacturing methods, adjust supply chains to reduce costs, etc.. This would follow the experience of Detroit automakers during the 1980s. In any event the author will be tracking the progress of the USITC investigations, which will be subject of future articles.

So, stay tuned…

________

Contact the Author: Steve Metzger at smetzger@smallvehicleresource.com. Or check out our website at www.smallvehicleresource.com, where you will find an extensive database of vehicle models and can make side-by-side comparisons of vehicles based on a full set of specifications.