What Look for in the PTV Market in 2023

The developments in products and markets have, I believe, set the stage for further expansion in 2023. Here is an overview of what I see coming in the new year. To some extent this is a preview of topics covered and analyzed in detail in SVRs upcoming, comprehensive report on the industry.

This article focuses on personal transportation vehicles (PTVs) as the most exciting segment of the market, and a vehicle type that could well extend into new, as yet untapped market opportunities.

Product improvements/upgrades

Upgrades, such as four-wheel disc brakes, electric power steering, drive by wire systems will continue to ripple through all product lines, further fostering and supporting the positioning of PTVs as a mainstream alternative to conventional automobiles in the mobility market.

Proactive safety systems coming in 2023

I expect to see level 2 autonomous driving technology placed in several models by leading manufacturers during the coming year. The technology comes from several directions. Companies like Turing Drive (Taiwan), Mobileye, (U.S)., and Baro Technologies, (U.K.) are moving product into the driverless vehicle market.

Turing Drive is specifically focused on the golf car-type vehicle market, while Mobileye is concentrating on the conventional vehicles. Baro features a versatile autonomous vehicle platform for finished vehicle developers, looking to a variety of mobility markets

Lithium batteries to break new ground

Lithium batteries, of course, have stormed into the PTV market and if not a standard component of many models, then a featured option. The key aspect of lithium batteries, as far as consumers are concerned, is their low maintenance, better extreme temperature durability, and the greater distance they provide—both because of weight and energy intensity.

With the manufacturing cost of lithium batteries declining and the opening up of new lithium extraction and refining resources, expect to see consumers opting for larger battery packs with ranges up to 150 miles or more.

A new company by the name of Nanotech from South Korea in collaboration LG Energy Solutions will be exhibiting their newly introduced battery at the upcoming PGA Show.

Powered by LG Lithium NMC (Nickel-Manganese-Cobalt) pouch cells, Nanointech is aiming to create a standard for mobility battery solutions. This, based on an in-house developed advanced Battery Management System (BMS) hardware and software design.

The lithium battery market has a growing number of entries, and intense competition invariably pushes manufacturers to lower their costs and upgrade their products. It will be interesting to see how Nanotech’s lithium-manganese-cobalt technology fares compared to the presently dominant lithium iron-phosphate chemistry of most other brands.

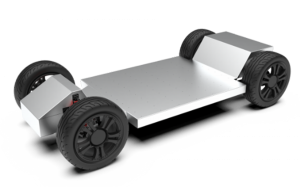

Another interesting aspect of the Nanotech product line is their X-series (the above being the N-series), which is configured in a skateboard design, and fitted within the dimensions of the vehicle frame.

This product is available only to OEMs, with the idea of modifying current vehicle designs to take advantage of the skateboard configuration. The flat design of this battery can potentially open up additional room within the driver/passenger vehicle interior, thus allowing, for example greater storage space.

Evolution of industry structure

We’ve cited it in other articles, that the supply side of the industry, that is to say, the manufacturing base is undergoing significant changes. A new supply paradigm with partially assembled vehicles, largely from China, are delivered to finish assembly plants in the U.S., has brought to fore a plethora of new entrants to challenge the historical dominance of Club Car, E-Z-GO, and Yamaha. Whether the newcomers can sustain their early success, only time will tell, but for the next three-to-five years they will be a significant presence in the market.

New competition has always brought the best in innovation, product improvement, and a search for new markets. Creative destruction at its best and most often a win-win situation for both consumers and producers.

Move to exploit new markets

Much has been written and analyzed about the micromobility market, as concerns, primarily, two-wheeled vehicles such as scooters, mopeds, e-bikes, and motorized skateboards. Companies such as Lime and one or two others have dominated the market and extended it on a global scales. These products are present in both the consumer and commercial markets.

The context of this market growth and a driver of it is the compelling need to:

• Reduce traffic congestion in urban settings, offering an alternative to automobiles and light trucks;

• Reduce the carbon footprint of urban transportation systems.

While the market for two-wheeled mobility vehicles (some are three-wheeled) has grown rapidly, there are limits to their use of some of these products. For example. on the consumer side, scooters and e-bikes may appeal to the younger set, they are not an option for the 50+ demographic. Secondly, not all urban environments are equal.

Recently, Bird announced its withdrawal of scooter fleets from small to mid-sized metropolitan areas throughout the U.S., citing operating and regulatory issues.

Thus, the question arises, does the PTV have a place in the urban/suburban mobility market. I believe the answer is yes. In fact, owners of PTVs are taking to the streets in increasing numbers, and municipal transportation officials across the countries are holding public meetings to discuss this trend and to establish regulations guiding their use—many times on a street-by-street basis.

We at SVR are forecasting a sizeable growth in the PTV market, as use on public streets grows. It should be noted also that consumer acceptance and affinity to the PTV option is a concomitant factor in street legal use and operation. We believe that the market will remain predominantly a private ownership market, although PTV fleets in self-contained gated communities is a strong possibility.

What will the 2023 PGA Show reveal concerning these product developments and likely market trends?

We at SVR are looking forward to attending the upcoming PGA Show and hoping to see breakthrough, disruptive products, as well as significant progressive upgrades in vehicle performance and quality. Stay tuned for the latest.

_________________________

Small Vehicle Resource (SVR) announces the publication of its 12th comprehensive analysis of the small, task-oriented vehicle industry

The analysis offers the following features:

• Focus on the multi-faceted developments in the personal transportation vehicle segment;

• Market share of new entrants, as compared with the Big Three—Club Car, E-Z-GO, Yamaha

• Comprehensive coverage of all major segment: Fleet, PTV, and light duty utility vehicles;

• Market trends from 2017 and forecasts to 2028;

• Impact of the latest technological advances and upgrades;

The comprehensive report will be followed by two updates, keeping track of key industry developments. This exclusive package is available for a subscription fee of $2,250.

If interested contact Stephen Metzger at smetzger@smallvehicleresource.com. Phone contact is (914) 293-7577

_________________________

Contact the Author: Steve Metzger at smetzger@smallvehicleresource.com. Or check out our website at www.smallvehicleresource.com, where you will find an extensive database of vehicle models and can make side-by-side comparisons of vehicles based on a full set of specifications.