Will Economic Problems Put a Brake on Your Purchasing Plans?

Storm clouds emerge over the U.S. economy as inflation remains resistant to Federal Reserve Bank’s restrictive policies. Inflation has two serious effects on consumers:

- Price increases without commensurate increases in wages and salaries translates into lower real income (your dollars are worth less in the market); and

- Inflation also decreases the value of your savings which are denominated in nominal dollar amounts.

(Note: If you have a portfolio which includes stocks, you may be protected against inflation, but let’s hope you picked the right stocks.)

Under the current trend of price increases it is very likely that real disposable incomes will, on average, decline. In this scenario consumer durables, including golf car-type (GCT) vehicles could take a hit.

Could market for GCT vehicles run counter to general market trends?

Conversely, the economic environment is experiencing on-going increases in the price of gasoline, the result of Administration policies which curb the supply of oil. Thus, comparing the cost of operation, plus the much lower average upfront cost of purchase, compared to a conventional vehicle, the GCT vehicle market has strong sustainability characteristics. Which of these factors—inflation negatives vs. lower cost of purchase and operation—will be the stronger holds the key to the outlook for 2023. Other factors will also impact the outlook:

- Continued positive change in consumer perceptions of GCT vehicles, positioning them in markets beyond golf;

- More public roads designated for certified LSV access;

- GCT vehicle upgrades appealing to consumer tastes and making them safer;

- Geofencing technologies conducive to mobility as a service.

Putting the pluses and possible minuses together, SVR anticipates short run growth in the market of 4.5-5% for the first half of 2023 and slightly higher for the full year.

Outlook over the long term is quite positive

Several long term demographic factors favor market growth:

- Population movement from colder northern States to a warmer climate in the South;

- Movement out of densely-populated urban centers to suburbs and smaller metropolitan areas;

- Growth of remote, home-office based occupations;

- Population aging;

- Unprecedented level of new company participants will greatly increase new vehicle supply.

Each of the above trends is long term in nature and have been emerging to varying degrees over the past decade. Each in its way lends itself to encouraging the use of GCT vehicles, whether privately-owned or used in fleets.

Population shift to the South

Looking at a sample of southern States, we see population gains over the 2010-2021 decade we see double-digit gains in population. This is in contrast to several northern States and California which experienced low single-digit increases.

Changes in Population, Selected Southern and Northern States & California From 2010 to 2021

|

State |

% Change |

Population (millions) |

|

TX |

17.0 |

29.2 |

|

FL |

15.6 |

21.8 |

|

AZ |

13.6 |

7.3 |

|

NC |

10.2 |

10.6 |

|

SC |

12.0 |

5.2 |

|

GA |

11.2 |

10.8 |

|

NY |

2.2` |

19.8 |

|

NJ |

5.5 |

9.3 |

|

CA |

5.1 |

39.4 |

|

IL |

-1.3 |

12,6 |

Source: Pew Research, U.S. Census

More recently, data from 2020 and 2021 shows net outward migration for the States of New York, New Jersey, and California. The population shift appears to be not only the attractiveness of warmer weather, but is highly correlated to tax regimes, the movement being toward States with lower taxes, which also tend to be southern States.

Population movement out of densely-populated urban centers

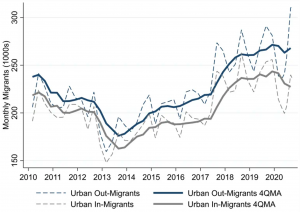

The Federal Reserve Bank of Cleveland has undertaken extensive analysis of population shifts, and in particular has studied the movement of populations out of urban areas. The following graphs depict quite dramatically the net out-migration of urban migrants around the country. The graph below shows the long term trend from 2010. (The graph following after indicates a shorter trend.)

Focusing on the solid lines in the graph, which are average quarterly movements, we see clearly that out migrations (the blue line) have been systematically outpacing in-migrations (the gray line). Notably, in the 2020-2021 period of the COVID epidemic, there was a sharp uptick in out-migration and one of the few periods in which in-migration did not track the out-migration trend—in other words it declined.

Long Term Trends in Urban out-Migration and In-Migration 2010-2021

Source: Federal Reserve Bank of Cleveland

Source: Federal Reserve Bank of Cleveland

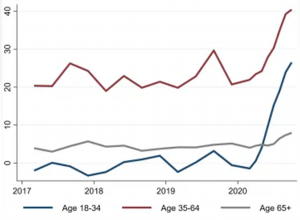

Turning to a shorter term trend, the graph below indicates net migration by age group. Two points can be made here: First, there is net out-migration in all age groups. Second, out migration of the 35-64 age group dominates. This suggests these are mature individuals and families, likely to be the highest income level of the three groups.

Monthly Net Urban Out Migrants (000s) by Age Groups, 2017-2021

Source: Federal Reserve Bank of Cleveland

Source: Federal Reserve Bank of Cleveland

The fact that better off families are moving out of urban areas to the suburbs and beyond bodes well for the GCT vehicle market. It is this demographic that is the strongest and most reliably sustainable population segment that underpins GCT vehicle demand.

Remotely-accessed work locations

The trend toward remotely located home-offices continues unabated since the COVID period. Actually, the trend predated the COVID outbreak, but accelerated during that time and continues. With the drive to work routine becoming significantly less important, so short distance travel as a percent of total vehicular travel increases markedly. In this environment the GCT vehicle can thrive as a viable mobility option to the conventional automobile.

Population aging

The U.S. population 65 and over increased from 13.0% in 2010 to 16.6% in 2020, according to the U.S. Census Bureau. While southern and western states such as Florida, Texas, and Arizona are retirement destinations, a number of norther states, such as New York, Pennsylvania, and Illinois retain a significant percentage of their elderly population.

In terms of market development, this aging trend sets up the possibility of mobility as a service—in particular, individual personal service, rather than multi-passenger transport. Autonomous, on-demand vehicles with destination and route mapping are on the way and could become an important market segment post 2025.

Overall economy will grow slowly over 2023—the Federal Reserve Banks’s revised outlook

In late March the Federal Reserve posted its latest projections for 2023 and 2024 for the U.S. economy. Overall, economic growth is minimal. The Fed reduced its outlook from 0.5% GDP growth in December to 0.4% in its latest projection. Thus, the economy is effectively stagnating. Even the Fed’s projection for 2025 and beyond is only slightly above 1%..

A number of factors appear to be playing into these pessimistic projections, noted below. The question is, will the scenario for the whole economy be mirrored in the market for GCT vehicles? Here are the factors influencing the economy in general:

- Continuing supply chain issues, albeit not nearly as acute as the 2020-2022 period;

- On-going decarbonization policies at the federal level, which result in curtailing both demand and supply of hydrocarbon resources;

- Efforts by the Fed to curtail inflation, leading to restrictive monetary policy and higher interest rates.

The upshot of these factors is not only slow growth of incomes, but the strong possibility of a recessionary downturn. In turn, consumers will be more cautious in the coming months, especially in the category of expenditures called durables. Durables big ticket items, such as large appliances and motor vehicles.

New market entrants swell supplies

The GCT vehicle industry has witnessed the arrival of numerous new entrants over the passed two years. With an abundance of partially assembled vehicles coming from China, the supply of finished GCT vehicles will be at an all-time high—dramatically higher than just two years ago.

The increase in production, including the final assemblies raises the risk of oversupply, potentially flooding the market with slow moving inventory. This key issue as to whether the market, while increasing, can absorb the extra supply, will be addressed in detail in SVR’s full report.

Despite the negatives, the GCT vehicle market should see continued growth in 2023 and 2024

Despite the list of negatives and uncertainties that are outlined above, SVR sees the market for GCT vehicles continuing to grow. Underlying near term growth over this year and next are two principal factors:

- Consumer perception of the GCT vehicle as a viable (and desirable) alternative to conventional automobiles and light trucks;

- Economy of operation, as compared to conventional vehicles.

Consistent upgrades in performance (lithium batteries), safety features (four-wheel hydraulic disk brakes), automotive styling and accessories (LCD displays,, power steering) Bluetooth, dashboards) are driving factor #1.

As for the second factor, given the so-called “green” policies of the current federal administration, as well as aggressive anti-oil polices of a number of states, the price of gasoline will continue to rise over the next two years, and barring a change in these policies, well beyond. In this environment, electric -powered GCT vehicles are increasingly attractive from a cost of operation standpoint.

Segment growth to remain positive in the midst of new market entrants

While the outlook for GCT vehicles is an uncertain mix of positives and negatives, SVR predicts positive growth in the key segments of LSv/PTVs and light duty utility vehicles (LDUVs) In both cases the outlook foresees a continuation of the trend over the past 3-4 years, despite the significant change in circumstances.

Note that this outlook begs the question concerning oversupply, as referenced above. A full analysis of the outlook and an in-depth look at each segment will be forthcoming in SVRs comprehensive report on the industry, scheduled for publication in late April.

_________________________

Contact the Author: Steve Metzger at smetzger@smallvehicleresource.com. Or check out our website at www.smallvehicleresource.com, where you will find an extensive database of vehicle models and can make side-by-side comparisons of vehicles based on a full set of specifications.